Introduction: India’s Trillion-Dollar Chip Dream – A New Era for Investors 🚀

Semiconductors, the microscopic silicon brains powering our digital world, have been aptly called “digital diamonds” and the “new oil” of the 21st century. These tiny chips, often smaller than a fingernail, carry immense economic and strategic power, forming the bedrock of everything from consumer smartphones and electric vehicles to critical military hardware and advanced artificial intelligence systems. For decades, India has been a voracious consumer of this critical technology, but a spectator in its production. That is now changing, creating unprecedented opportunities for semiconductor stocks in India.

- Introduction: India’s Trillion-Dollar Chip Dream – A New Era for Investors 🚀

- Part I: The Foundation – Why India is Betting Big on Semiconductors 🏗️

- Part II: Mapping the Ecosystem – Where to Invest in the Value Chain 🗺️

- Part III: In-Depth Stock Analysis – The Top Semiconductor Plays in India 📈

- Part IV: The Investor’s Playbook – Strategy, Risks, and Outlook 🎲

- Additional Resources for Investors 📚

After a long history marked by a series of missed opportunities, India is undertaking a generational pivot. The nation is embarking on an ambitious, state-supported mission to transform itself from a mere “chip taker” into a globally significant “chip maker.” This is not just another industrial policy; it is a strategic imperative driven by the goals of national security, economic sovereignty, and technological self-reliance, or Atmanirbhar Bharat. This transformation is opening new avenues for investors looking at semiconductor stocks in India.

A powerful confluence of factors is fueling this transformation: decisive government action, a fundamental rebalancing of global supply chains, and a massive infusion of private capital. This alignment is creating what many analysts believe will be a multi-decade investment super-cycle in the Indian semiconductor ecosystem. For discerning investors, this inflection point presents a historic opportunity in semiconductor stocks in India. This report serves as a comprehensive, in-depth guide to understanding this complex landscape, from the macro-level policy catalysts to the micro-level analysis of the publicly listed companies poised to define India’s semiconductor future.

Part I: The Foundation – Why India is Betting Big on Semiconductors 🏗️

1.1 The Strategic Imperative: From ‘Chip Taker’ to ‘Chip Maker’

India’s aggressive push into semiconductor manufacturing is not a choice but a necessity, born from a combination of economic vulnerability, geopolitical opportunity, and immense domestic market potential. This shift is creating compelling investment opportunities in semiconductor stocks in India.

The Problem of Dependency ⚠️

India’s digital economy runs on foreign-made chips. The country’s semiconductor consumption was valued at approximately $24 billion and is projected to skyrocket to over $100-120 billion by 2030 according to India Electronics and Semiconductor Association (IESA). This near-total reliance on imports, primarily from Taiwan, China, and South Korea, creates profound vulnerabilities. The global chip shortage during the COVID-19 pandemic served as a stark reminder of this fragility, bringing entire industries like automotive production to a standstill. This dependency results in a significant trade deficit, with electronics imports reaching $67.6 billion in 2022, and exposes the nation’s critical infrastructure to geopolitical shocks. Building a domestic manufacturing base is therefore essential for de-risking the economy and ensuring technological sovereignty, making semiconductor stocks in India increasingly attractive.

Geopolitical Tailwinds (The China+1 Factor) 🌏

The intensifying technological rivalry between the United States and China has fundamentally altered the global semiconductor landscape. As Western nations and their allies seek to de-risk their supply chains away from China and the geopolitically sensitive region of Taiwan, a unique window of opportunity has opened for India. Global deliberations now underscore the confidence in India’s emergence as a trusted and reliable hub for both innovation and manufacturing. This “China+1” strategy, where global corporations diversify their manufacturing bases, positions India as a politically stable, democratic alternative, making it an attractive destination for long-term capital investment and boosting prospects for semiconductor stocks in India.

This favorable geopolitical climate is the key differentiator between the current initiative and past failed attempts. For decades, India missed opportunities to attract global giants like Fairchild, Texas Instruments, and Intel due to policy hesitancy, bureaucratic delays, and a lack of strategic clarity. Today, the global strategic imperative for supply chain diversification provides a powerful external motivation, ensuring sustained, high-level government focus. This significantly reduces the policy risk that plagued earlier efforts, creating a more stable and predictable environment for investors in semiconductor stocks in India.

Sizing the Opportunity 📊

The scale of the market is staggering. The global semiconductor industry is on a trajectory to become a trillion-dollar business by 2030 according to McKinsey & Company. India’s domestic market alone is expected to constitute a substantial portion of this, with consumption projected to reach $110 billion by the end of the decade. This massive and growing internal demand provides a foundational offtake for new domestic manufacturing facilities, a crucial advantage that reduces reliance on export markets in the initial stages. Prime Minister Narendra Modi has articulated a clear vision for India to capture a significant share of this expanding global market, directly benefiting semiconductor stocks in India.

1.2 Decoding Government Policy: The ₹76,000 Crore Catalyst 💰

At the heart of India’s semiconductor ambition is a comprehensive and well-funded policy framework designed to attract investment, nurture domestic talent, and build a complete ecosystem that will drive growth in semiconductor stocks in India.

The India Semiconductor Mission (ISM) 🎯

Established in December 2021, the India Semiconductor Mission (ISM) acts as the nodal agency under the Ministry of Electronics and Information Technology (MeitY). Its primary role is to serve as a single window for vetting investment proposals and ensuring the seamless implementation of the various incentive schemes, providing clarity and coherence to the government’s efforts to boost semiconductor stocks in India.

The Incentive Arsenal (PLI, DLI, SPECS) 💼

The government has committed a massive ₹76,000 crore (approximately $10 billion) outlay to catalyze the ecosystem, with a suite of schemes targeting different parts of the value chain, directly impacting semiconductor stocks in India.

Semicon India Programme (PLI): This is the flagship scheme, offering substantial fiscal support to de-risk the enormous capital expenditure required for manufacturing. It provides uniform fiscal support of 50% of the project cost on a pari-passu basis for setting up Semiconductor Fabs (including Silicon, Compound, and Display) and facilities for Assembly, Testing, Marking, and Packaging (ATMP), also known as Outsourced Semiconductor Assembly and Test (OSAT). This direct subsidy addresses the primary barrier to entry in an industry where a single advanced fab can cost over $10 billion according to semiconductor industry reports.

Design Linked Incentive (DLI) Scheme: Recognizing India’s inherent strength in chip design, the DLI scheme aims to nurture a vibrant fabless ecosystem. It provides financial incentives of up to 50% of eligible expenditure and offers design infrastructure support—including access to Electronic Design Automation (EDA) tools and intellectual property (IP) cores—to domestic companies, startups, and MSMEs. This policy directly supports the “Design in India” objective and helps create domestic customers for future fabs, strengthening semiconductor stocks in India.

Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS): This scheme targets the broader downstream value chain. It provides a financial incentive of 25% on capital expenditure for manufacturing electronic components, specialized sub-assemblies, and the capital goods required for their production, thereby strengthening the ancillary ecosystem supporting semiconductor stocks in India.

Talent Development 🎓

A critical pillar of the strategy is building a skilled workforce. The government has acknowledged the talent gap in specialized manufacturing and initiated programs to address it. The “Chips to Startup” (C2S) program, with a ₹1,000 crore investment, aims to train 85,000 engineers in Very Large-Scale Integration (VLSI) and embedded system design over five years. This is complemented by numerous Memorandums of Understanding (MoUs) between government bodies, academic institutions like IITs and IISc, and international partners like the Singapore Semiconductor Industry Association and Arizona State University to bolster skilling and industry-academia linkages, ultimately benefiting semiconductor stocks in India.

India’s Semiconductor Policy Toolkit 📋

| Scheme Name | Total Outlay (Indicative) | Key Incentive | Target Segment | Nodal Agency |

|---|---|---|---|---|

| Semicon India Programme (PLI) | ₹76,000 Crore (overall ecosystem) | 50% of project cost | Semiconductor Fabs, Display Fabs, OSAT/ATMP | India Semiconductor Mission (ISM) |

| Design Linked Incentive (DLI) | Part of ₹76,000 Cr outlay | Up to 50% of expenditure + infrastructure support | Fabless Chip Design (Startups, MSMEs) | C-DAC (under ISM) |

| SPECS | ~$440 Million | 25% on capital expenditure | Electronic Components, Sub-assemblies | MeitY |

| Modified EMC 2.0 | ~$500 Million | 50% of project cost for clusters | Shared Infrastructure, Common Facility Centres | MeitY |

Part II: Mapping the Ecosystem – Where to Invest in the Value Chain 🗺️

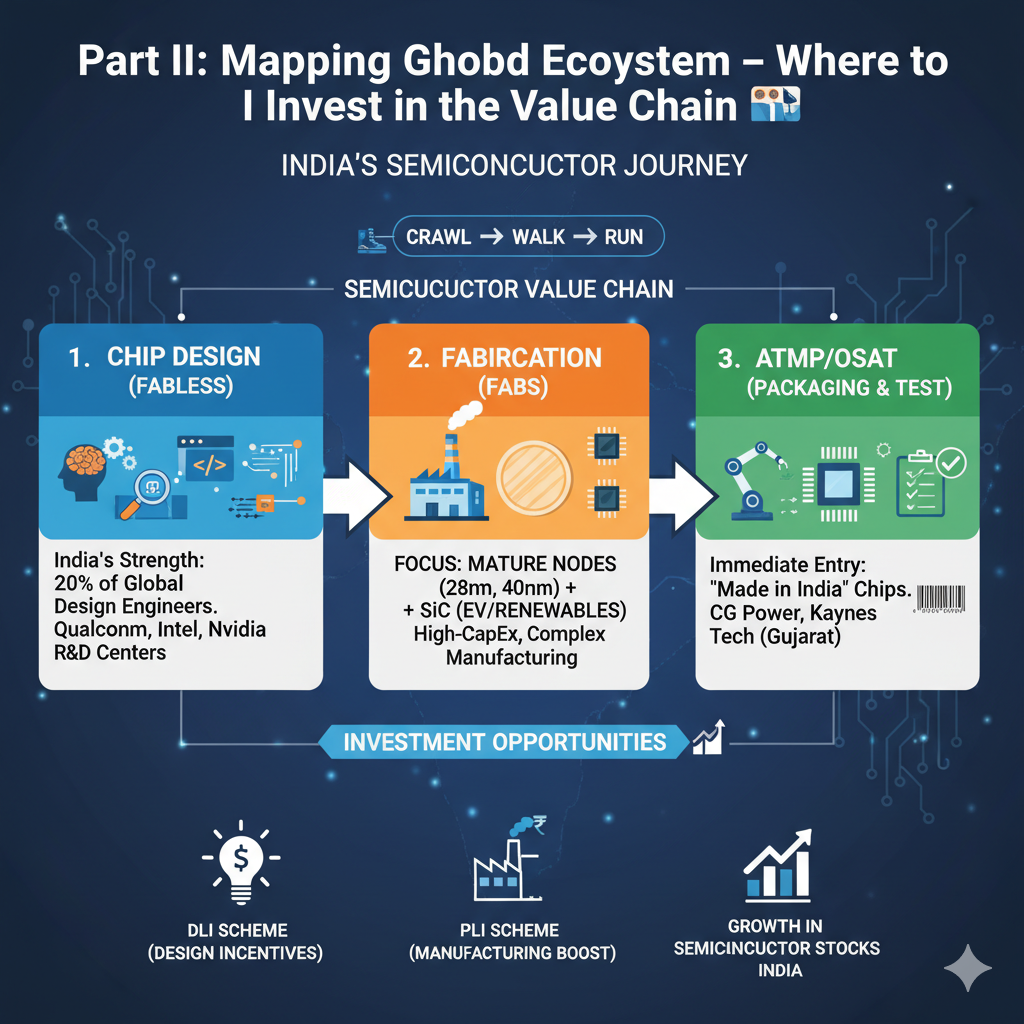

For an investor evaluating semiconductor stocks in India, understanding the structure of the semiconductor industry is crucial to identifying where value is created and which companies are best positioned to capture it. The ecosystem is broadly divided into three core stages.

2.1 The Semiconductor Value Chain Explained for Investors 🔄

Chip Design (Fabless): This is the intellectual property (IP)-heavy, capital-light segment of the industry. Companies in this space are the architects of the chip, creating the intricate blueprints that define its function. This has long been India’s greatest strength. The country is a global powerhouse in chip design, hosting approximately 20% of the world’s semiconductor design engineers according to NASSCOM. Global leaders like Qualcomm, Intel, Nvidia, and MediaTek have established large R&D and design centers in cities like Bengaluru, Hyderabad, and Noida, leveraging India’s vast pool of engineering talent, creating opportunities in semiconductor stocks in India.

Fabrication (Fabs): This is the heart of semiconductor manufacturing—the highly complex and capital-intensive process of transforming raw silicon wafers into integrated circuits. Fabs are among the most sophisticated manufacturing facilities in the world. A key concept here is the “process node,” measured in nanometers (nm), which refers to the size of the transistors on the chip. Smaller nodes (like 3nm) represent more advanced, powerful, and expensive technology, while larger, “mature” nodes (like 28nm, 40nm, or 180nm) are used for a wide range of applications in automotive, industrial, and consumer electronics. India’s initial foray is strategically focused on these mature nodes, which are the workhorses of the electronics industry, offering growth potential for semiconductor stocks in India.

Assembly, Testing, Marking, and Packaging (ATMP/OSAT): This is the final and crucial stage of the manufacturing process. Here, the finished wafers from the fab are sliced into individual chips (dies), which are then encapsulated in protective packaging, tested for quality and performance, and marked for identification. This segment is less capital-intensive than fabrication but requires high-volume, precision manufacturing capabilities. For India, OSAT represents the most tangible and immediate entry point into the manufacturing value chain, with the first “Made in India” chips expected to roll out from these facilities, driving growth in semiconductor stocks in India.

2.2 India’s Current Standing: Strengths, Gaps, and Strategic Choices 💪

India’s approach to building its semiconductor ecosystem is pragmatic and phased, playing to its strengths while systematically addressing its weaknesses, creating diverse opportunities in semiconductor stocks in India.

Established Strength: India’s position as a global leader in design services is undisputed and provides a strong foundation. The DLI scheme is designed to further consolidate this advantage by fostering domestic IP creation.

Emerging Strength: The most significant and visible progress is occurring in the OSAT segment. Multiple large-scale projects have been approved under the PLI scheme, with companies like CG Power and Kaynes Technology establishing state-of-the-art facilities, primarily in the Dholera and Sanand regions of Gujarat. This is where the “Made in India” manufacturing story is beginning to take concrete shape, benefiting semiconductor stocks in India.

The Final Frontier: Fabrication remains the most challenging piece of the puzzle. While ambitious plans have been announced, this segment is still in its nascent stages. The government’s strategy appears to be twofold: first, to attract investment in mature silicon nodes (28nm and above) that cater to the high-volume domestic market; and second, to carve out a niche in emerging compound semiconductors, such as Silicon Carbide (SiC). SiC chips are critical for high-power applications like electric vehicles and renewable energy systems. By focusing on SiC, India can enter a high-growth market without directly competing with established global leaders in cutting-edge silicon technology, opening new avenues for semiconductor stocks in India.

This phased approach can be understood as a “crawl, walk, run” strategy. The “crawl” phase involves strengthening the already world-class design ecosystem through the DLI scheme. The “walk” phase, which is currently underway, is the build-out of a robust OSAT and ATMP infrastructure. Success in this stage is paramount, as it will demonstrate to the world that India can master high-volume, precision electronics manufacturing—a fundamentally different skill set from design. A thriving OSAT ecosystem creates a powerful “pull” for domestic fabs; Indian chip designers would finally have a local, end-to-end supply chain, reducing costs and turnaround times. This builds confidence among global technology partners and investors, de-risking the entire national strategy and making the massive capital outlay required for the “run” phase—advanced fabrication—a more viable proposition in the future, ultimately boosting semiconductor stocks in India.

Part III: In-Depth Stock Analysis – The Top Semiconductor Plays in India 📈

The universe of listed Indian companies offering exposure to the semiconductor theme is diverse. It includes new entrants making direct plays in manufacturing, established design houses, large conglomerates with ambitious plans, and ancillary players who act as proxies for the ecosystem’s growth. The following analysis categorizes these semiconductor stocks in India to provide investors with a clear framework for evaluation.

3.1 The OSAT Pioneers: Building India’s Manufacturing Muscle 🏭

This category represents the most direct investment play on India’s semiconductor manufacturing ambitions through semiconductor stocks in India. These companies are at the forefront of establishing the crucial assembly and testing infrastructure.

CG Power and Industrial Solutions (NSE: CGPOWER) ⚡

Business Model: A well-established engineering conglomerate and part of the Murugappa Group, CG Power has traditionally focused on power systems and industrial solutions. It is now making a formidable strategic entry into semiconductor manufacturing through its wholly-owned subsidiary, CG Semi, becoming one of the prominent semiconductor stocks in India.

Key Developments: In a landmark event, the company recently inaugurated one of India’s first end-to-end OSAT facilities in Sanand, Gujarat. The company has announced a massive investment plan of over ₹7,600 crore ($870 million) over the next five years to develop two advanced facilities, G1 and G2. The project is backed by strategic collaborations with global partners Renesas Electronics of Japan and Stars Microelectronics of Thailand, which provide crucial technology and operational expertise.

Financials & Growth: The venture is strongly backed by the financial might of the Murugappa Group. The G1 facility will have a peak capacity of 0.5 million units per day, while the larger G2 facility, expected to be completed by 2026, will scale production to 14.5 million units per day. This move has attracted significant investor attention, with global brokerage Morgan Stanley initiating coverage and forecasting a 34% CAGR in profit after tax between FY25 and FY28, citing the semiconductor expansion as a primary growth driver.

Investment Thesis: CG Power represents a compelling, large-cap bet among semiconductor stocks in India on the successful execution of India’s semiconductor manufacturing vision. Its established engineering legacy and the backing of a major industrial group provide a degree of credibility. A successful ramp-up of its OSAT business could lead to a significant re-rating of the stock. The primary risk lies in the execution of a new, highly complex business line and the ability to achieve globally competitive yields and efficiency.

Kaynes Technology India Ltd (NSE: KAYNES) 🔧

Business Model: Kaynes Technology is a leading end-to-end and IoT-enabled integrated Electronics Manufacturing Services (EMS) company. It is aggressively diversifying into the semiconductor value chain through its subsidiary, Kaynes Semicon, focusing on OSAT and advanced packaging solutions, establishing itself among key semiconductor stocks in India.

Key Developments: The company is establishing its OSAT facility in Sanand, Gujarat, with pilot operations having begun in April and commercial production targeted for early 2026. Critically, it has secured a multi-year deal with US-based Alpha & Omega Semiconductor (AOS), a global supplier of power semiconductors, to serve as an anchor customer. This agreement is expected to utilize approximately 60% of the plant’s first-phase capacity and includes provisions for technology transfer and workforce training. Kaynes has also entered into a strategic collaboration with US Technology International (UST) to bolster its packaging business.

Financials & Growth: Kaynes Semicon has a clear ambition to build a $300 million semiconductor business within four to five years, which would contribute a significant 20-30% to the group’s overall revenues. The project is heavily supported by government incentives, with the central government providing 50% and the Gujarat state government providing 20% of the ₹3,307 crore investment, substantially reducing the company’s net capital expenditure.

Investment Thesis: Among semiconductor stocks in India, Kaynes offers a more focused OSAT play compared to the diversified CG Power. The presence of a strong anchor client like AOS significantly de-risks the initial revenue stream and provides a crucial technology partnership. The key challenge for the company will be to successfully scale its high-volume manufacturing operations and expand its customer base beyond the anchor client to achieve its ambitious growth targets.

SPEL Semiconductor Ltd (BSE: 517166) 🎯

Business Model: SPEL is India’s first and oldest OSAT company, offering integrated circuit (IC) assembly and testing services for several decades. It provides packaging solutions for semiconductors used in communications, consumer electronics, and automotive applications, making it one of the pioneer semiconductor stocks in India.

Key Developments: As a long-standing player, SPEL offers pure-play exposure to the OSAT market. However, it operates on a much smaller scale and lacks the massive new investments and government backing seen by new entrants like CG Power and Kaynes.

Financials & Growth: The company has faced financial headwinds, posting losses in recent quarters and reporting a negative Return on Equity (ROE) for three consecutive years. Despite weak fundamentals, the stock has delivered extraordinary returns over the last five years, with a reported gain of over 2300%, likely driven by high speculative interest in the sector’s potential and its status as one of the few listed pure-play companies.

Investment Thesis: Among semiconductor stocks in India, SPEL is a high-risk, high-reward micro-cap investment. Its future hinges on its ability to modernize its facilities and effectively compete with the new, well-funded, and technologically advanced players entering its domain. It could potentially benefit from overflow demand if the larger ecosystem thrives or could become an attractive acquisition target for a larger player seeking an established footprint.

3.2 The Design & Services Powerhouses: Leveraging India’s IP Strength 🧠

This category includes companies that capitalize on India’s established leadership in semiconductor design and engineering services. They represent the “brains” of the industry and are important semiconductor stocks in India.

Tata Elxsi Ltd (NSE: TATAELXSI) 💻

Business Model: A part of the Tata Group, Tata Elxsi is a world-leading provider of design and technology services. Its role in the semiconductor ecosystem is not in manufacturing but as a high-end service provider, offering specialized services in chip design, verification, validation, and embedded software development for global clients in key industries like automotive, communications, and healthcare.

Key Developments: While Tata Elxsi is a services company, the broader Tata Group is making one of the largest single investments in the Indian semiconductor space. Tata Electronics is investing $14.3 billion in manufacturing, including a major fab in Dholera, Gujarat. This creates immense potential for synergistic collaboration, positioning Tata Elxsi to provide critical design and engineering support for the group’s manufacturing ambitions.

Financials & Growth: Tata Elxsi is a fundamentally strong, debt-free company with a consistent track record of high profitability and return on equity. Its growth is closely tied to global R&D spending trends in its core verticals. Analyst forecasts suggest steady earnings growth of around 11% per annum, reflecting a mature and stable business model.

Investment Thesis: Among semiconductor stocks in India, Tata Elxsi offers a stable, lower-risk avenue to invest in the Indian semiconductor theme. It represents a bet on the high-value, IP-driven end of the value chain where India already possesses a global competitive advantage. Its valuation is often at a premium, reflecting its quality and brand parentage, but it provides durable exposure to the ecosystem’s most advanced segment.

MosChip Technologies Ltd (NSE: MOSCHIP) 🎨

Business Model: MosChip is a fabless semiconductor company that provides end-to-end solutions, specializing in Turnkey Application-Specific Integrated Circuits (ASICs), mixed-signal IP, and system design services. It caters to industries such as aerospace, defense, consumer electronics, and automotive, positioning itself among specialized semiconductor stocks in India.

Key Developments: As a domestic fabless design company, MosChip is a prime candidate to benefit from the government’s Design Linked Incentive (DLI) scheme. The stock has witnessed a significant rally recently, fueled by the positive sentiment generated by major announcements at the Semicon India 2025 summit, which highlighted the government’s strong focus on nurturing homegrown design capabilities.

Financials & Growth: MosChip is a small-cap company that is virtually debt-free and has demonstrated strong sales growth. As of the June quarter, promoters held a significant 44.28% stake. However, the company lacks institutional or mutual fund holdings, with a large portion of the free float held by retail investors.

Investment Thesis: Among semiconductor stocks in India, MosChip is a direct, high-beta play on the “Design in India” narrative. Its growth trajectory is directly linked to the success of the DLI scheme and its ability to secure design contracts in a competitive global market. The stock’s recent sharp appreciation indicates that high expectations for its future performance are already priced in, making it a higher-risk proposition.

3.3 The Strategic Entrants & Ecosystem Proxies 🏢

This group includes large, diversified companies making strategic forays into chip manufacturing and key players in the electronics manufacturing ecosystem who stand to benefit indirectly from the growth of domestic semiconductor production, representing alternative ways to invest in semiconductor stocks in India.

Vedanta Ltd (NSE: VEDL) ⛏️

Business Model: Vedanta is one of India’s largest diversified natural resources conglomerates, with interests spanning metals, mining, and oil and gas. The company has announced an ambitious plan to enter the semiconductor and display fabrication business, potentially becoming a major player among semiconductor stocks in India.

Key Developments: The company’s initial plan was a $19.5 billion joint venture with Taiwanese electronics giant Foxconn to build a fab in Dholera, Gujarat. However, Foxconn has since withdrawn from the JV. Vedanta has stated its intention to move forward with the project, claiming it has secured a production-grade technology license for 40nm chips from a prominent Integrated Device Manufacturer (IDM) and is actively seeking new partners. The plan involves setting up a fab with a capacity of 40,000 wafer starts per month, initially focusing on 40nm and later transitioning to 28nm technology.

Financials & Growth: The semiconductor venture is a long-term project and is not yet reflected in the company’s financials. Vedanta’s stock performance is currently driven by the cyclical trends in the global commodities markets.

Investment Thesis: Among semiconductor stocks in India, Vedanta represents a high-risk, potentially transformative bet on India’s fab manufacturing future. If the company successfully executes its monumental plan, it could become the cornerstone of the country’s entire electronics manufacturing ecosystem. However, the challenges are immense, including securing a new, credible technology partner and raising the massive capital required. Investing in Vedanta for its semiconductor plans is an option on a future possibility rather than a current business reality.

Dixon Technologies (India) Ltd (NSE: DIXON) 📱

Business Model: Dixon is India’s largest Electronic Manufacturing Services (EMS) company. It is a contract manufacturer for some of the world’s biggest brands, producing a wide range of products including mobile phones, televisions, washing machines, and lighting for clients like Samsung, Xiaomi, Motorola, and Panasonic, making it an indirect play on semiconductor stocks in India.

Key Developments: Dixon is not a chip manufacturer, but it is one of the biggest domestic consumers of semiconductors and a primary beneficiary of the PLI schemes for large-scale electronics manufacturing and IT hardware. As the government pushes for greater domestic value addition in electronics, the demand from companies like Dixon will provide a crucial customer base for India’s new semiconductor fabs and OSAT facilities.

Financials & Growth: Dixon is a high-growth company with an exceptional track record of execution, reflected in its strong revenue and profit growth over the last five years. Its future growth is tied to winning new manufacturing contracts and expanding into new product categories like IT hardware (laptops) and telecom equipment, for which it is establishing new production facilities.

Investment Thesis: Dixon Technologies is an indirect but powerful “proxy play” on the entire semiconductor and electronics manufacturing theme, offering an alternative approach to semiconductor stocks in India. The success of India’s “Make in India” and chip-making ambitions is intrinsically linked to the growth of its end-market electronics industry, where Dixon is the undisputed leader. It offers investors a way to participate in the rising demand for chips without taking on the direct technological and execution risks associated with semiconductor manufacturing itself.

Comparative Analysis of Indian Semiconductor Stocks 📊

| Company (Ticker) | Market Cap (₹ Cr.) | P/E Ratio (TTM) | Role in Value Chain | Key Govt. Scheme Beneficiary | Investment Thesis Summary |

|---|---|---|---|---|---|

| CG Power (CGPOWER) | 1,12,712 | 112.62 | OSAT/ATMP | PLI for Semiconductors | Large-cap industrial major making a strategic, well-funded entry into OSAT. A bet on manufacturing execution. |

| Kaynes Technology (KAYNES) | 47,111 | 148.39 | OSAT/ATMP, EMS | PLI for Semiconductors | Focused OSAT play with an anchor client de-risking initial phase. High growth potential with execution risk. |

| SPEL Semiconductor (SPEL) | ~1,049 | Negative | OSAT/ATMP | (Eligible for PLI) | Micro-cap pure-play OSAT. High-risk due to weak financials and new competition, but high speculative interest. |

| Tata Elxsi (TATAELXSI) | 34,089 | 45.74 | Design & Services | DLI (Indirectly) | Stable, high-quality play on India’s design strength. Lower risk, but premium valuation. |

| MosChip Tech (MOSCHIP) | ~5,041 | High | Fabless Design | DLI | Direct, high-beta play on the “Design in India” theme. High expectations priced in after recent rally. |

| Vedanta (VEDL) | 1,65,539 | 12.01 | Fabrication (Planned) | PLI for Semiconductors | High-risk, long-term option on India’s fab ambitions. Success is transformative but highly uncertain. |

| Dixon Technologies (DIXON) | 1,07,962 | 88.75 | End-Market (EMS) | PLI for Electronics & IT Hardware | Powerful proxy play on the end-demand for chips. A bet on the growth of the overall electronics ecosystem. |

Note: Market Cap and P/E Ratios are based on available data from September 2025 and are subject to market fluctuations.

Part IV: The Investor’s Playbook – Strategy, Risks, and Outlook 🎲

Investing in an emerging, capital-intensive sector like semiconductors requires a clear strategy and a sober understanding of the associated risks. The potential rewards from semiconductor stocks in India are substantial, but the path is unlikely to be linear.

4.1 Building a Semiconductor Portfolio: A Strategic Approach 📈

A balanced approach is advisable for navigating the different risk profiles within semiconductor stocks in India.

Core-Satellite Strategy: A prudent approach would be to build a portfolio with a stable “core” and higher-growth “satellites.” The core could consist of established, profitable companies like Tata Elxsi, which represent India’s proven strength in design services. The satellites could include higher-risk, higher-reward companies directly involved in manufacturing, such as the OSAT pioneers CG Power and Kaynes Technology, or the fabless design firm MosChip Technologies.

The Proxy Route: For investors with a more conservative risk appetite, gaining exposure through an ecosystem proxy like Dixon Technologies is a sound strategy when investing in semiconductor stocks in India. This allows participation in the growth of electronics consumption, which is the ultimate driver of semiconductor demand, without taking on the direct technological and execution risks of chip manufacturing.

4.2 Navigating the Inherent Risks: A Sober Assessment ⚠️

While the long-term outlook for semiconductor stocks in India is promising, investors must be cognizant of the significant challenges that lie ahead.

Execution & Gestation Risk: Building and ramping up semiconductor facilities is one of the most complex manufacturing undertakings in the world according to industry experts. The journey from groundbreaking to achieving high, profitable yields can take several years, and projects are susceptible to delays and cost overruns. The initial years will be a period of heavy investment with limited cash flow.

Technology & Obsolescence Risk: India is strategically starting its manufacturing journey with mature process nodes (e.g., 28nm, 40nm). While these nodes have a long life and are crucial for the automotive and industrial sectors, the global semiconductor industry is defined by rapid technological advancement. There is a persistent risk that the pace of innovation could outstrip the development of India’s ecosystem, impacting long-term competitiveness of semiconductor stocks in India.

Capital Intensity & Cyclicality: The semiconductor industry is famously cyclical, with periods of high demand and shortages often followed by periods of oversupply and price corrections as noted by Gartner research. It also demands continuous and massive capital expenditure to upgrade technology and expand capacity, which can strain balance sheets during downturns.

Talent Gap: While India boasts a world-class pool of design engineers, there is a recognized shortage of talent with hands-on experience in the highly specialized fields of wafer fabrication, process engineering, and advanced packaging. The success of government and industry-led skilling initiatives is critical to overcoming this bottleneck but is not guaranteed, which could impact semiconductor stocks in India.

Valuation Risk: The immense excitement surrounding India’s semiconductor story has already driven sharp rallies in many of the associated stocks. Current valuations may have priced in a perfect execution scenario. Any delays or setbacks could lead to significant corrections, and investors must be cautious about entering these semiconductor stocks in India at peak valuations.

4.3 The Long-Term Vision: India’s “Semicon-omy” 🔮

India’s semiconductor journey is a marathon, not a sprint. The current policy framework, backed by strong political will and favorable geopolitical tailwinds, represents the most credible and powerful push the country has ever made in this sector. After decades of hesitation, India is finally moving from the backend to becoming a full-stack semiconductor nation, creating unprecedented opportunities in semiconductor stocks in India.

For long-term, patient investors, the opportunity is not just in the potential stock price appreciation but in participating in the creation of a foundational industry for India’s 21st-century economy. The next three to five years will be a critical period of execution for semiconductor stocks in India. Key milestones to monitor will be:

- ✅ The successful ramp-up of the first OSAT facilities

- ✅ The achievement of commercial-scale production and yields

- ✅ The groundbreaking of the first commercial semiconductor fabs

- ✅ The continued growth of the domestic design ecosystem

The path will involve challenges, but for those who understand the risks and share the long-term vision, the opportunity to invest in India’s “digital diamonds” through semiconductor stocks in India at this historic inflection point is truly compelling. As the nation transforms from a chip consumer to a chip producer, early investors in semiconductor stocks in India could potentially reap significant rewards in the coming decade.

Additional Resources for Investors 📚

- India Semiconductor Mission Official Portal

- IESA – India Electronics and Semiconductor Association

- MeitY – Ministry of Electronics and IT

- Invest India – Semiconductor Sector Overview

- NASSCOM Reports on Semiconductor Industry

- Semicon India Conference Updates

- Global Semiconductor Alliance

Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Please consult with a qualified financial advisor before making any investment decisions in semiconductor stocks in India.

![[Guaranteed] 101 PROVEN Strategies To CREATE Money Online [LIMITED EDITION]](https://trendpaisa.com/wp-content/uploads/2025/03/WhatsApp-Image-2025-03-03-at-8.53.22-PM-300x300.jpeg)